Caps and Closures Market to Surpass 2,799 Billion Units in 2021 as Application Surges in the Food & Beverage Industry

STELVIN® Pressure from Amcor is a closure with a special liner for lightly sparkling wines.

Image courtesy of Amcor

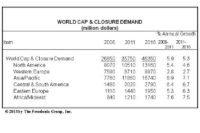

As per a recently published report by FMI, the global caps and closures market is estimated to total US$ 79.1 Bn in 2021. Thanks to the increasing demand from personal and home care, pharmaceutical, and food & beverage industries, the market is poised to reach US$ 141 Bn by 2031, growing at a CAGR of 5.6% during the forecast period from 2021 to 2031.

Caps and closures application is rising in the food & beverage industry. They are used for packaging bottles, jars, containers, and packaging items. Rise in consumption of ready-to-eat food and drinks will therefore create opportunities for sales. Also, increasing demand for small and convenient packaging solutions for personal care and beverages owing to the "on-the-go" trend is expected to create lucrative growth opportunities for the market.

Growing concerns regarding kids' safety and regulations mandating child-resistant packaging have compelled leading manufacturers to focus on producing child-resistant (CR) caps and closures. For example, Berry Global, Inc. a packaging giant announced introducing new PalmSoft child-resistant closure in 2019, with innovative features such as easy to open and close. Driven by such developments, the sales of caps and closures are expected to reach 2,799 billion units, growing at a year-on-year (YoY) growth of 3.1% in 2021.

On the basis of product type, screw closures are estimated to hold a lion's share in the market, accounting for around than 51% of total sales. Attributes such as easy closing and opening mechanism, and reasonable cost of manufacturing and selling are facilitating the growth of the segment.

Key Takeaways from Caps and Closures Market Study

- The U.S. market is expected to account for nearly 75% of the sales in North America, growing at a CAGR of 3.5% over the assessment period.

- Germany is estimated to emerge as a highly remunerative market in Europe, contributing around 16% of the sales in the region by 2021.

- Favored by the increasing demand for dairy and milk products in India, the country is projected to account for over 23% of the revenue share in the Asia Pacific market by 2031.

- Demand for screw closures is forecast to surge at 3.4%, totaling sales of nearly 1,580 billion units during the forecast period 2021-2031.

- Based on material, plastic is anticipated to remain the dominant segment, expanding at a CAGR of 5.7% by the end of the next ten years.

Key Drivers

- Rapidly expanding food & beverage industry and increasing demand for ready-to-eat food products and drink across the U.S., the U.K., Germany, China, and India among others are spurring the sales of caps and closures.

- Increasing application of screw closures across various industries due to their exceptional sealing attributes and popularity among manufacturers is propelling the demand for screw closures.

Key Restraints

- Implementation of regulations banning the use of plastics across the world is hampering the growth of the plastics caps and closures segment.

- High cost of metal and aluminum caps and closures compared to other substitutes such as bioplastics and polypropylenes is hindering the sales across metal and aluminum segments.

Competitive Landscape

As per FMI, top seven player operating in the global market are Crown Holdings Inc, BERICAP Holding GmbH, Guala Closures S.p.A, Closure Systems International, Inc., Berry Plastics Group, Inc, Amcor Plc, and Silgan Plastic Closure Solutions. These players are expected to account for nearly 05% to 10% revenue share in the market.

Leading players are focusing on capacity expansion and acquisition of local and regional players, to increase the production capacity, minimize operational costs, and expand regional footprint. For instance,

- In June 2021, BERICAP Holding GmbH, a leading closures manufacturer based in Germany, announced acquiring a metal processing company in Schweina, Germany, Mala Verschluss-Systeme GmbH. This acquisition will assist the company to expand its product portfolio by including aluminum closures.

- In March 2020, Berry Global, Inc., a U.S.-based marketer of plastic packaging products, announced investing around US$ 30 million to expand the production capacity for ultra-high performance sport caps and closures in its North American location

Some of the key players operating in the market profiled by FMI are:

- Crown Holdings Inc

- BERICAP Holding GmbH

- Guala Closures S.p.A

- Closure Systems International, Inc

- Amcor Plc

- Silgan Plastic Closure Solutions

- Aptar Group

- UNITED CAPS

- Nippon Closures Co., Ltd.

- Mold-Rite Plastics, LLC

- O.Berk Company, LLC

- Pelliconi & C. Spa.

- Weener Plastik GmbH

- Blackhawk Molding Co. Inc

By Product:

- Screw Closures

- Snap Closures

- Push-Pull Closures

- Tethered Caps

- Others

By Production Process:

- Injection Molding

- Compression Molding

- Others (Blow Molding, and more)

By Material:

- Plastic

- Polyethylene

- HDPE

- LDPE

- Polypropylene

- Homopolymer

- Copolymer

- Random

- PCR

- Bioplastics

- Others (PET, PA, and more)

- Metal

- Aluminium

- Others

By End Use:

- Food & Beverage

- Consumer Goods

- Personal and Homecare

- Pharmaceuticals

- Others

By Region:

- North America

- Latin America

- Europe

- APAC

- MEA

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!