World demand for packaging machinery to reach $41.8 billion in 2017

Growth in worldwide demand for packaging machinery is expected to climb at a 4.6% annual pace through 2017 to $41.8 billion. An improved business climate -- which will be reflected in expanding fixed investment spending, manufacturing output, and packaging demand -- will drive increases in equipment sales through 2017. These and other trends are presented in World Packaging Machinery, a new study from The Freedonia Group, Inc. (www.freedoniagroup.com), a Cleveland-based industry market research firm.

Machines used in the packaging of chemicals, pharmaceuticals, and personal care products will post the fastest sales gains in percentage terms. Purchases of packaged pharmaceuticals and consumer goods -- and associated equipment demand -- will be boosted by rising living standards in developing nations. Food manufacturing will remain the largest market for packaging equipment, accounting for about 40% of total sales.

Labeling and coding equipment will be the fastest growing major product type in value terms due to the increasing need for pharmaceutical, food, and beverage manufacturers to ensure the safety of their products throughout the supply chain. However, filling and form/fill/seal machines will remain the most widely used type of packaging equipment through 2017, with demand bolstered by their extensive use in the large food processing market.

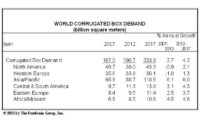

Developing markets will provide the best growth opportunities for suppliers of packaging equipment through 2017. Demand in the Asia/Pacific region will expand 5.7 percent annually, led by the sizeable national markets of India and China. China and India together will account for 21% of global packaging machinery demand in that year. Central and South America will also record a strong sales performance through 2017, though from a much smaller existing market base. Rising personal incomes in these regions will provide the greatest impetus to equipment sales, supported by healthy gains in packaging demand, manufacturing output, and fixed investment spending. The US is currently the largest national market for packaging equipment. Although it will be surpassed in size by the much more rapidly expanding Chinese market by 2017, the US will continue to account for about one-sixth of the world demand total.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!