Home » packaging waste

Articles Tagged with ''packaging waste''

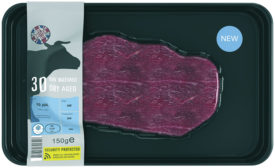

Market Trends: Meat Packaging

Meating the Packaging Challenge

The meat packaging sector demands high-quality packaging solutions, requiring excellent presentation with a focus on shelf-life extension.

August 14, 2018

Cover Story

Packaging Outlook 2018: Flexible Packaging Overview

This report is an excerpt from the 2018 Packaging Outlook Report, featured in Packaging Strategies NEWS.

March 1, 2018