Smithers Pira forecasts corrugated board packaging market to hit $269 billion in 2021

World demand for corrugated board packaging will increase steadily across the next five years according to the latest exclusive market data from Smithers Pira (smitherspira.com). In its new report, "The Future of Global Corrugated Packaging to 2021," Smithers’ critical analysis of the key drivers shaping this segment show that a market with an annual consumption value of $222 billion in 2015 will expand to be worth $269 billion in 2021, and consume 160 million tonnes of board in that year.

Importantly the outlook for material suppliers, board converters and users in various segments and regions will be different across the study period. With electrical goods and processed foods, for example, outpacing growth in fresh foods and produce and paper products, like office paper.

Globally growth in demand for corrugated board packaging is showing signs of a slowdown. For 2009-2015, volume consumption of corrugated board grew on average by 4.3% annually, but this is expected to decrease to 3.6% annually in 2016-2021. This is largely due to the slowdown in the Chinese economy coupled with sluggish to negative prospects in North America and Western Europe.

Cost will remain the core motivator for changes in the corrugated packaging industry – and this will not be restricted to raw material production alone – with a new emphasis on the impact electricity prices can have on production facilities. There are also positive developments for the corrugated industry, such as a recent study of the use of rigid plastic containers (RPCs) in tomato delivery in Mexico, which shows that corrugated board can be far more cost-effective, despite the re-usability of RPCs.

“Macroeconomic influences of course exert some influence on the demand for corrugated board packaging, including issues such as urbanization, growing disposable incomes in emerging economies, ageing and growing populations, smaller family units,” says Stephen Harrod, author of the report.

“However, industry specific trends and drivers tend to exert greater and more direct influence on the market.”

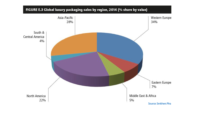

Regionally, the market has seen a distinct shift eastwards, with Asia’s market share blooming from just over 40% in 2009 to over 46% in 2015, and this is likely to continue over the medium term with the region accounting for more than half of the global market by 2021. This may be a result of the Chinese government embarking on a program of mill closures to rid the market of out-dated, inefficient paper machines, targeting over 8 million tonnes of capacity across all paper and board products, and focusing on linerboard and fluting machines less than two metres wide and slower than 80 metres/minute.

The ongoing penetration of internet shopping into consumer behavior is seeding a spate of innovation in the corrugated market, with companies taking on the challenge of what they term ‘frustration-free’ packaging; as well as corrugated producers designing clever ways of ensuring the safe transportation of goods via the postal service to reduce the cost of delivery by courier and enable easy returns.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!