Market insight

Four key trends driving flexible packaging

Submitted by: Smithers Pira

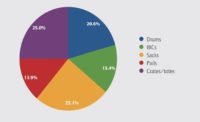

The global market for flexible packaging is forecast to grow at an annual average rate of 3.4% over the next five years, and is expected to reach $248 billion by 2020. This dynamic packaging sector offers huge potential for technology suppliers, packaging converters and brand owners.

Flexible packaging is the most economical method to package, preserve and distribute food, beverages, other consumables, pharmaceuticals and other products that need extended shelf life. It can be designed with barrier properties tailored to fit the products being packaged and their end-uses, whereas other barrier packaging formats generally provide a one-size-fits-all approach. Flexible packaging can now be made in a wide variety of innovative shapes, sizes and appearances, and can include components, such as handles; and opening and reclosing features, such as zips and spouts.

Smithers Pira draws on its most recent market data to identify the four key trends which are driving the market for flexible packaging.

1. Downgauging

Flexible packaging uses less resources and energy than other forms of packaging. It provides significant reductions in packaging costs, materials use and transport costs as well as certain performance advantages over rigid packaging. Use of flexible packaging can minimise package transport costs between the converter, packer/filler, retailer and end user. It not only takes up less space when empty than rigid packaging, but can also be constructed on the spot from roll materials at the filling location, thereby minimizing transportation of ready-formed empty packaging.

A key trend for flexible plastic packaging is continued downgauging as the combination of environmental pressures and high polymer prices make customers demand even thinner films.

This downgauging of plastic films will continue even though many of the traditional films are reaching the limits of this trend. The flexible packaging industry will begin to promote more of the ‘pre-cycling’ benefits of these packages versus rigids as the combination of environmental pressures and uncertain polymer prices persist. No declines for paper and aluminum foil are forecast as demand for them reached the bottom line in many regions.

2. High-performance films

As the other end of the spectrum to thinner films is the rise and importance of high-performance films. The trend in food packaging films is towards high-performance film structures that are less permeable to increase shelf life and enhance flavours. Growth is occurring from the transition of items packaged in rigid containers to high quality flexible packages. Non-food packaging applications are industrial and agricultural.

A growing share of premium products – including products sold in modified atmosphere packaging (MAP) – is also favourable for flexible packaging in baked goods. Some of these products are gluten-free bread, breakfast goods, such as croissants, pancakes, partly baked bread, and rolls; specialty bread; and cakes.

Two other favourable trends are increased pressure from retailers to extend shelf life, and a shift in foodservice sandwich bread from frozen to MAP-packaged bread.

The ongoing success of flexible packaging as a replacement for glass and metal packages, particularly retorted and hot-filled products, can be attributed directly to the substantial improvements in barrier properties of plastic films and particularly clear plastic films.

One of the advantages of flexible packaging is the ability of the brand owner to ‘dial in’ the barrier-based on product and shelf life requirements. With glass and metal packaging, very high barriers are incorporated whether they are needed or not. For example, packaging refrigerated milk in a glass container is completely unnecessary to maintain product shelf life. Milk oxidises very slowly at refrigerated temperatures and therefore does not require a barrier package at all.

The other extreme would be wine, which – even at refrigerated temperatures – reacts with oxygen very quickly and is suitable for a glass container. Flexible packaging can be easily designed for both types of products and all levels of moisture and oxygen barrier needs in both clear and opaque formats. For the most part, barrier flexible packaging for retail products is a lamination of several plies of plastic, so the level of barrier necessary can be accomplished through one or more of the plies.

3. Consumer Convenience

As more and more consumers lead increasingly busy and hectic lifestyles, they do not have the time to cook meals from scratch, preferring to opt for convenient mealtime solutions instead. This puts ready meals in new flexible packaging formats in a prime position to take advantage of the current social and economic trends.

Packaged fresh meat, fish & poultry consumption will grow at a faster rate than unpackaged produce to 2020. This trend is explained by consumer demand for more convenient solutions and the growing dominance of the large supermarkets where packaged foods provide longer shelf life.

Chilled food consumption has grown steadily during over last decade, driven by increasing numbers in supermarkets and hypermarkets, especially in developing markets, and consumer demand for convenience products that are precooked, pre-roasted or pre-sliced. Growth in the pre-sliced sector and in premium lines has promoted growing demand for MAP packaging. Demand for chilled food is also being driven by a greater variety of ready meals, fresh pasta, seafood and exotic meats, and a trend towards more convenience food purchases by time-conscious consumers.

4. Bio-derived and bio-degradable technologies

In the past few years, a number of new product launches involving bio-based plastic packaging have taken place. The proliferation of bio-based plastic films continues with polylactic acid (PLA), polyhydroxyalkanoates (PHA) and poly-trimethylene terephthalate (PTMT) showing the most promise on the truly materials side of the equation, and thermoplastic starch (TPS) films on the petroleum replacement side.

Brazil’s Braschem Green PE has made large strides on the latter, with much of the PE consumed in Brazil coming from locally grown sugar cane raw materials. Braschem is having some success outside of its own region as well, with the large US-based bakery Bimbo Bakeries USA recently switching its Eureka! Organic Bread bags from petroleum based PE to Braschem’s sugarcane based materials. While these bags are only 36% bio-based, this represents a significant change, especially in a package that is usually considered very low cost.

Emerald Packaging, a US–based flexible packaging converter, has launched a bag for potatoes that is manufactured partly from potato starch. The film is 25% potato starch resin and 75% low-density polyethylene mixture. Emerald claims that the film is stronger than 100% low-density polyethylene (LDPE) film.

This research is based on Smithers Pira's (smitherspira.com) report, The Future of Global Flexible Packaging to 2020.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!