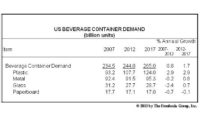

US demand for beverage containers to reach 283 billion units in 2019

US demand for beverage containers is expected to increase 1.9% per year to 283 billion units in 2019, valued at $31.5 billion. Proliferation of different package sizes, new product introductions, and increased consumption of healthier beverages such as bottled water, ready-to-drink (RTD) tea, and nondairy milk alternatives will drive increases despite weakness in critical markets such as carbonated soft drinks and beer. Plastic bottles and metal cans will continue to dominate demand, with over 80% of the total. However, faster growth is expected in newer formats such as aluminum bottles, bag-in-box products, aseptic cartons, and pouches. These and other trends are presented in Beverage Containers, a new study from The Freedonia Group, Inc., a Cleveland-based industry market research firm.

Plastic containers will remain both the largest and fastest growing product segment, with gains supported by increased consumption of bottled water, the primary outlet for plastic bottles and the leading market for beverage containers by 2019. According to analyst Katie Wieser, “Going forward, though, growth will slow somewhat as environmental concerns lead some consumers to favor filtered tap water or to use reusable bottles for on-the-go consumption.” Plastic is expected to gain ground in newer uses including RTD tea, RTD coffee, and larger size alcoholic beverages. Plastic pouches will also continue to see increased use outside of juice drinks with new introductions in sports drinks, wine, and flavored alcoholic beverages taking advantage of the convenience and low cost of this package format.

Metal containers are the second most prevalent package type within the beverage container industry, but demand for cans is expected to show only minimal growth through 2019 due to continued weakness in carbonated soft drinks and beer, the two key markets for aluminum cans. Nevertheless, the growing popularity of smaller cans in the carbonated soft drink market, as well as increased can use in growing markets such as wine and sparkling beverages, will help metal cans maintain a sizable market share as producers take advantage of their light weight and recyclability. Glass bottle demand will continue to decline through 2019, although the rate of decline will level off. Glass has already been phased out in most nonalcoholic beverage markets and is starting to experience competition in alcoholic beverages as well, especially for products where cost and convenience are valued over image and tradition. Demand for paperboard containers will post above average gains through 2019 as healthy growth for aseptic and bag-in-box containers offsets declines in the gabletop carton format.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!