Industrial machinery market growth to double in 2014

High demand for machines in manufacturing sectors ranging from auto making to packaging will push the industrial machinery market to new heights during the next five years, highlighted by a doubling of growth this year, according to a new report from IHS Technology (technology.ihs.com).

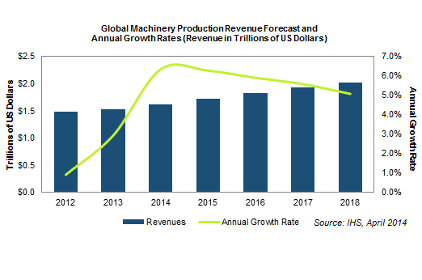

As economic conditions continue to improve worldwide, the demand for machines in sectors such as agriculture, packaging, materials handling and machine tools will push revenues to $1.6 trillion this year, up from $1.5 trillion in 2013. This represents annual growth of 6.3%, more than twice the 2.9% increase seen in 2013.

Strong growth is forecast to continue for the next four years, with revenue rising to $2.0 trillion by 2018, as shown in the attached figure. During this period, the machinery market’s annual growth rate will remain quite impressive, averaging between 5% and 6%.

“The improving economic outlook is a key factor in the strong growth of machinery in the coming years,” says Andrew Robertson, senior analyst for industrial automation at IHS. “The growing populations and the expanding middle classes in developing countries are generating more disposable income. This translates into increased demand across a vast number of sectors.”

Sales growth for industrial machines in 2014 is being driven by a number of factors.

First, higher demand for cars worldwide is spurring the requirement for more spending on tools and robotics in the automotive business, as well as the rubber and plastics segments. Meanwhile, an increase in the standard of living and growing spending on nutrition will benefit the food and packaging machinery sectors.

Furthermore, rising spending on technology products will boost the demand for robotics, semiconductor equipment, mining, and oil and gas machinery.

At the same time, increased demand for housing, infrastructure and commercial buildings is benefiting the construction equipment sectors. Moreover, social awareness of green technologies is resulting in higher demand for industrial machines in photovoltaics (PV) and in wind turbines.

These findings are contained in the Machinery Production Market Tracker, from the Machinery group at IHS.

The right package

Packaging is a sector that is slated for high growth in the next few years. The increase in packaging market growth will come from an investment in lighter packaging. Such packaging requires less material, generates less waste, is more energy efficient to produce and has improved aesthetic appeal.

Lighter packaging options are also suitable for developing countries where processed products are becoming more attainable for a growing middle class.

Furthermore, advances in packaging—such as wrapping food in ready-to-cook enclosures, cartons that are never pierced until opened and new aseptic packaging technology—are promoting demand for industrial machines in this sector.

“Whether for convenience, improved shelf life or better taste, new industrial machines are contributing to the continued growth of the packaging market,” Robertson says.

China comeback

For the past two years, the machinery market in China has experienced considerable overcapacity, specifically in the construction machinery, machine tools and metal working sectors. Machinery production revenue slowed to 1.8% growth in 2012, a huge dip from the 20% growth average from a decade before. As a result, only a few businesses experienced growth, while weak investment in 2013 caused many heavy industries to struggle.

IHS forecasts that this will all be changing in the future as production revenue growth rises to between 10.9% and 8.1% each year during the forecast period.

Turbulent past

The growth of the machinery market represents a welcome change from just two years ago when not every region performed well. The Americas prospered in 2012, boosted by a significant government investment that caused machinery production revenue to grow by 6.5%. In 2013, machinery production growth in the Americas slowed to 2.0%, but still fared better than some of the other regions.

In the Asia-Pacific region, however, growth slowed to only 3.5%. A majority of this slowdown came from China, where production remained nearly flat because of overcapacity.

Meanwhile, Europe struggled as a result of the economic problems persisting throughout the region, and machinery production revenue declined by 5.6% in 2012, dragging down the entire global market. Europe increased output last year, but only by 1.1%.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!