The consumer packaging markets in India forecast to grow

The consumer packaging sector in India has grown rapidly over the last two decades with significant investments in modern technology, capacity enhancement and the introduction of new products according to “The Consumer Packaging Markets in India: A Five-year forecast to 2017-18” report from the Madras Consultancy Group (consultmcg.com). While the packaging sector in India continues to be highly fragmented with thousands of small converters, there is some evidence of consolidation taking place amongst the medium-sized and larger units. In the recent years, this sector is also attracting the attention of the global packaging players and a few have commenced operations through setting up of wholly owned subsidiaries or JVs while a few others have taken the acquisition route.

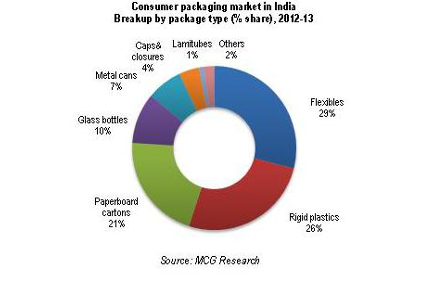

Consumer packaging market in India

The growth in the packaging sector in India has been ahead of the nation’s GDP growth. The Indian consumer packaging market is estimated at around USD 8.7 billion in 2012-13 and is forecast to reach USD 15 billion by 2017-18.

Flexible packaging is the leading packaging type in the consumer packaging market at 29% followed by rigid plastics at 26%. Paperboard packaging including folding cartons, liquid packaging cartons and composite containers accounted for 21% share of the market.

Food including beverages accounted for a share of 52% of the total consumer packaging market in 2012-13. Demand for consumer packaging from the food sector is forecast to grow at a CAGR of around 11%.

Demand for consumer packaging from the beverage sector is expected to grow marginally ahead of other user sectors at around 12% during 2012 to 2017. Main contributors to this growth include bottled water, fruit-based beverages and CSD PET bottles are set to gain the most from this growth.

In the non-food sector, pharmaceuticals, household products and personal care products will influence the demand for consumer packaging.

The research report on Indian consumer packaging market covers all major end user sectors spread across non-food, food and beverages segments, as outlined below. Brief profiles of each end use sector including market dimension, key players and recent developments have been compiled as a part of the report.

-

The flexible packaging market for consumer products, growing ahead of other packaging types in India, was valued at around USD 2.5 billion in 2012-13

- Milk & dairy products are the major users followed closely by convenience foods and snack foods

- The major user of flexible packaging in the non-food sector is the pharmaceuticals

-

Usage of rigid plastics is driven by the beverage and personal care segments and is forecast to grow at 10.9% during 2012-17

- PET bottles are the material of choice for beverage packaging while HDPE bottles are preferred for non-food applications including hair care and skin care products

- PP bottles and jars are used for malted milk food, talcum powder and pharmaceutical products

-

Paperboard packaging market in India is estimated at about USD 1.8 billion in 2012-13

- Main user of paperboard packaging in the non-food sector is the pharmaceutical sector followed by the personal care sector

- Demand for liquid carton in the beverage sector is likely to grow faster during the next five years

-

Glass bottles and metal cans have lost their shares significantly to flexible packaging and rigid plastics

- Estimated at USD 843 million in 2012-13, glass packaging is still the preferred medium for some of the product categories; primary users of glass packaging in India re the alcoholic beverage and pharmaceutical sectors

- In the metal packaging sector, demand for aluminium beverage cans and aerosols will increase significantly in the next few years, largely driven by carbonated soft drink, beer and deodorants markets

- Caps & closures and lamitube segments are witnessing focussed research and development to cater new application

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!