Everyone knows that the protein trend has gone beyond the tipping point, but there are many other growth opportunities powering the food and health market, according to 12 Key Trends 2014, the annual industry forecast authored by Julian Mellentin and published by New Nutrition Business.

“Dairy as a naturally functional whole food, slow energy, weight wellness, healthy snacking and ‘permission to indulge’ all present a wealth of possibilities for food and beverage companies,” says Mellentin.

Weight wellness (Key Trend 5): Weight management is no longer a special category of foods. Consumers now think about weight as part of their everyday food choices and as a way of maintaining wellness. Says Mellentin: “This is creating winners and losers. Unilever’s and Nestlé’s weight management strategies lie in ruins, because they are based on an understanding of the market that was out of date five years ago.” Slim-Fast sales are down 80% and Nestlé is selling off most of its Jenny Craig business. Entrepreneurs who connect to consumers’ desire for an individualised approach based on normal foods, and who also connect to the most important trends, are the ones who are being most successful. An example is thinkThin, which offers products that are gluten-free (Key Trend 10), use minimal sugar (Key Trend 8), deliver 10g of protein (Key Trend 3) and use natural ingredients such as dark chocolate (Key Trend 1) to give people “Permission to indulge” (Key Trend 9).

Slow energy (Key Trend 7): Worldwide, interest in products delivering “slow release” or “sustained” energy has increased sharply, driven by the global success of Belvita breakfast biscuits. Although many companies are thinking about slow energy and blood glucose control in relation to diabetes, in fact the biggest opportunity for the food and beverage industry lies in providing sustained energy to the mass market. As yet, this is an early-stage trend, the claims are complex and the consumer messaging is difficult to get right. Product developers are turning to slowly digestible carbohydrates such as oats, barley, sorghum and millet. New science is also underscoring dairy protein’s role (Key Trends 2 and 3) in delivering slow energy.

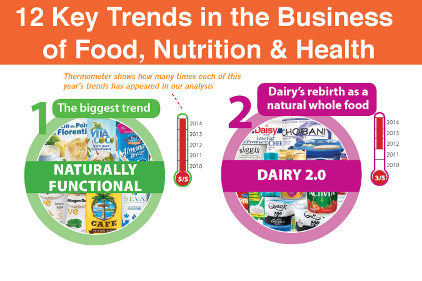

Overlaying all of these trends is Key Trend 1, Naturally Functional. However, cautions Mellentin, “If you want to be successful, don’t use the word natural on your product. You run the risk of getting bogged down in a regulatory minefield – and there are plenty of other ways of communicating the naturalness of your product without ever using the word ‘natural’.”

The evidence is that in convenient product formats, “naturally healthy” ingredients will help give your product a health halo – and increase sales, sometimes significantly.

Examples include:

Coconut water. Sales of coconut water – the liquid found inside green coconuts aged less than 9 months – in the US have surged from zero in 2007 to over $390 million (€289 million) today on the back of its strong “naturally healthy” and “nothing added” image. Mellentin predicts that Canadian maple water, which has a similar excellent all-natural nutritional profile to coconut water, and an appealing taste, will be one of the biggest growth areas over the next five years, if maple water brands get their marketing right.

Almond milk. From almost zero four years ago, US sales of almond milk rose 51% in 2013 to $497 million/€368 million (SPINS/Nielsen). The great nutritional profile and health halo of almonds in the minds of consumers extends to most things that contain almonds.