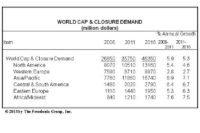

Demand for caps and closures rises worldwide

World demand to rise 5.3% annually through 2016

According to a report from Reportlinker (www.reportlinker.com), World demand for caps and closures is projected to rise 5.3% per year to $46 billion in 2016. In volume terms, demand will grow 4.1% annually to 1.9 trillion units. Value gains will be supported by raw material price increases and greater use of value-added closures such as dispensing, child-resistant, and tamper-evident types. Unit advances will be driven by the continued popularity of single-serving bottles in the beverage market and further inroads by plastic containers into closureless packaging segments such as metal cans. Other factors contributing to rising demand include growth in global manufacturing output, increased consumer spending on packaged goods worldwide, and the use of closures on popular container types such as gabletop cartons, aseptic cartons, and spouted stand-up pouches.

Beverages to remain largest cap & closure market

The beverage segment will remain by far the single largest cap and closure market.

Gains will be supported by the continued popularity of single-serving beverages and the widening presence of plastic bottles in markets once dominated by glass bottles and metal cans. However, preventing faster gains will be the maturity of several large beverage applications such as beer and carbonated soft drinks. Also moderating demand growth will be continued competition from closureless packaging options, such as aluminum beverage cans, peelable lidding, and pouches. Furthermore, a significant deceleration in bottled water growth due to environmental concerns will also moderate cap and closure prospects, as will the commodity nature of most beverage closures. Opportunities in the food market will benefit from demand for dispensing and other valueadded closures such as non-drip flip top pourer caps, boosted by convenience advantages.

Plastic caps & closures will post fastest growth

In terms of materials, plastic will continue to account for the largest share of cap and closure demand and will also see the fastest increases. The global cap and closure industry is directly affected by container demand trends and changes in the container mix resulting from competition among various packaging media. Plastic containers, which typically use plastic closures, will continue to gain market share at the expense of metal, paperboard, and glass packaging due to their cost advantages, shatter resistance, resealability, and graphics capabilities, as well as improved resin and processing technologies resulting in enhanced barrier properties, heat resistance, and design flexibility.

Demand for metal caps and closures will exhibit below average growth, as they continue to lose market share to plastic closures. Furthermore, demand for metal crown caps, which are often used with glass bottles, will be restrained by weak gains in glass packaging. The heavier weight of glass containers and their risk of breakage will continue to limit gains -- especially in export markets -- due to high shipping costs. Among other closure types, elastomer and rubber stopper demand will register strong gains, driven by widespread use with plastic vials and large volume parenteral packaging in the pharmaceutical, medical diagnostic, and other health care markets. Cork demand will see sluggish growth, due to stiff competition from relatively less expensive synthetic corks and aluminum screw caps in the wine market.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!