Packaged water to become soft drinks leader in 2015

Global consumption of bottled water has doubled in the past decade, and is set to continue growth to replace carbonates as the leading soft drinks category.

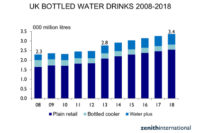

It was not that long ago that the idea of buying water in a bottle seemed outrageously quirky to most people, but over the past few decades the demand for packaged water has rocketed exponentially. Just ten years ago world consumption stood at one hundred billion liters. Since then, and despite the global downturn, volumes have actually doubled. Perhaps even more amazing is that, according to Canadean’s latest calculations, packaged water will actually overtake carbonates as the leading soft drinks category in just two years. This anticipated result is being bolstered by its healthy image, plus actual necessity in those areas of the world lacking alternative, safe, water supplies.

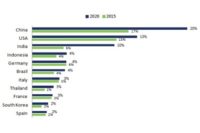

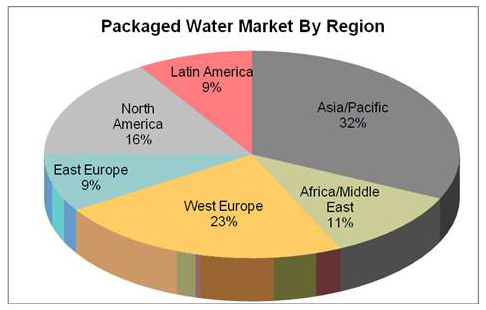

The main thrust behind this category re-positioning is coming from Asia. Volumes here are predicted to rise by around 16% in this year alone; that is more than twice the global rate of increase. Yet, the region already absorbs one in every three liters of packaged water consumed around the world. But per capita intake remains well below the international average, especially in under-developed markets like Pakistan, the Philippines and Vietnam where it is still less than ten liters per capita. This underlines the huge market potential still to be released in this part of the world.

Asian growth has a strong dependency on China where major suppliers like the Blue Sword Group, China Resources Enterprises, Coca-Cola and Zhejiang Nongfushanquan Water Co are helping to drive expansion. But, as well as the Chinese market being huge, it also remains fragmented. Despite a combined volume in the order of seven billion liters, these four players are responsible for less than a third of category sales. Yet, whilst China represents the cornerstone of Asian packaged water consumption, Canadean can reveal that it is India that is seeing the more dynamic advances, at well over 20% a year.

The North American packaged water market is also huge with sales now in excess of 30 billion liters, but the pace of development is far less vibrant than in Asia. Volumes suffered here during the recessionary years and took time to recover; but the rate of annual growth is now re-accelerating. Recent progress has been partly driven by packaged water’s improved value offering, with consumers switching from other beverages where prices have risen more steeply. At the same time, the category has benefited from its intrinsic low calorie proposition relative to alternative mainstream soft drinks. However, conditions remain very challenging as a combination of relatively low growth and wafer thin profit margins make it hard for suppliers to commit to long-term investment in brand support. This is not seen to deter future volume expansion.

What is most reassuring for packaged water is that Canadean sees a positive future across all regions, even in West Europe where demand was struggling to increase even before the start of the economic crisis. Progress is currently being held back by such negative factors as approaching category maturity in Germany. Added to this is the threat posed by competing water filters and local authority initiatives promoting tap water in Italy. Nevertheless, market positivity is slowly returning, with almost 900 million liters predicted to join the regional pool by 2018. The packaged water category can look forward to a very bright future indeed.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!