Food processing, packaging machinery exports hit record levels in 2023: VDMA

(Courtesy of VDMA)

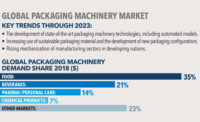

In 2023, German manufacturers of food processing and packaging machinery achieved a nominal export growth of 8.6 percent, reaching a record value of 9.85 billion euros. However, German manufacturers were not the only ones to benefit from the strong global demand. According to the data available to date, the global trade in food processing and packaging machinery is believed to have risen to over 52 billion euros in 2023.

"On the one hand, we benefit from the continuing high level of investment in automated, efficient and sustainable production and packaging technologies in industrialized countries and, on the other, from the growth momentum in populous countries," says Beatrix Fraese, economic expert at the VDMA Food Processing and Packaging Machinery Association, which represents more than 3,500 German and European mechanical and plant engineering companies.

Last year, 53 percent – and therefore more than half of exports – were delivered to countries outside Europe, with the focus on Asia and North America.

Food and beverage sector strongest industry in many countries

In many emerging economies, including the populous countries of India, Indonesia, Mexico, Brazil and Nigeria, for example, the food and beverage industries are the strongest industrial sectors (source: United Nations Industries Development Organisation UNIDO).

By investing in hygienic processing and packaging technology, these often resource-rich countries are increasing local value creation and self-sufficiency in safe, long-life food and beverages. They are increasingly moving away from exporting pure raw materials and instead exporting their own products in the region and, in some cases, worldwide.

"The potential is far from exhausted and will continue to ensure a strong demand for machinery," Fraese said.

The food and beverage industry is also the largest industrial sector in many industrialized countries, especially in the USA. In the United States, the sector employs almost 2 million people and generated a production value of over 1.1 trillion euros in 2023 (source: Euromonitor International).

Against the backdrop of a lack of skilled labor, the sector continues to invest in automated, efficient and stable processes. This ensures that imports of machinery are constantly reaching new records. German manufacturers have been the USA's most important trading partner in the food processing and packaging machinery segment for many years.

USA remains No. 1 market - India and Mexico among the Top 10

German deliveries of food processing and packaging machinery to the United States rose by 19 percent in 2023 to 1.7 billion euros, which corresponds to an all-time high.

The USA has led the ranks of the top 10 sales markets for many years. France, China, the United Kingdom, Poland, Switzerland, Mexico, the Netherlands, India and Italy followed far behind in 2023.

From a regional perspective, German manufacturers sold 33 percent of exported machines in EU countries. A further 14 percent went to other European countries, 19 percent to North America, 17 percent to Asia, 8 percent to Central/South America, 4 percent to Africa, 3 percent to the Near/Middle East and 2 percent to Australia/Oceania.

Global machinery trade reaches record level in 2023

The global trade in machinery - the sum of exports from around 50 industrialized countries - reflects the global demand for imported food processing and packaging machinery and has been growing dynamically for years.

Over the last 10 years, global trade in machinery has increased by 43 percent from €33.9 billion in 2012 to €48.6 billion in 2022, with EU countries accounting for a good 60 percent of this. This makes the European food machinery and packaging machinery industry the most successful mechanical engineering segment in Europe, with Germany and Italy leading the way.

According to the data available to date, the global trade in food processing and packaging machinery ultimately will be shown to have increased to over 52 billion euros in 2023 despite difficult conditions, which corresponds to an increase of around 7 percent.

"We also see growth for our industry in 2024, as the global demand for safe and high-performance machines remains immense," Fraese said, pointing to the strongest investment drivers, namely hygiene and food safety, automation and efficiency improvements, resource conservation and sustainability in production and the packaging process.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!