Flexible Packaging

Converting Trends: Providing Sustainable Flexible Packaging Amid Volatility

February 19, 2025

Flexible Packaging

Converting Trends: Providing Sustainable Flexible Packaging Amid Volatility

February 19, 2025Bioplastic pellets that will be converted into flexible packaging. Image courtesy of Aquapak

With 2030’s sustainability goals looming ever larger over the packaging industry, many businesses are turning to flexible packaging innovations to provide a solution.

2025 will be one of the most consequential years in the history of the packaging industry. Having hit the halfway point of the decade, many brand and retailer customers are increasing the pressure on converters to keep their 2030 goals on track. Meanwhile, this year will see a tidal wave of regulations hit the sector, from the introduction of extended producer responsibility (EPR) fees to the EU’s Packaging and Packaging Waste Regulation (PPWR), and more.

These issues all stem from the same source – the drive for sustainability. While most proposals are undoubtedly positive long-term measures aimed at protecting the planet, the fact is they will be introduced during a time of rising costs and volatile supply chains. It’s not surprising that many are turning to innovations in flexible packaging to overcome these challenges.

Image courtesy of Flexible Packaging Association

“The overall trend toward making packaging that is reusable, compostable, or recyclable will continue, especially as more states continue to explore the implementation of EPR legislation. Sustainability and regulations will likely continue to drive the headlines for packaging, and in particular flexible packaging. The need to drive design, collection, sortation, reprocessing and end-markets will become more enhanced as EPR programs are implemented in the first states. While there is not a one-size-fits-all solution, the use of paper-based and mono-material structures with new barrier technologies will likely play an important role.”

– Dan Felton, President & CEO, Flexible Packaging Association

Image courtesy of TC Transcontinental

“Convenience remains at the forefront of packaging converting trends, with consumers favoring features that enhance usability. Re-closure options for frozen foods, dry foods, confections, and even pet food, and easy-tear designs cater to those purchasing in bulk, helping preserve freshness and reduce waste. Durability is another factor, particularly for packaging fresh products like pet food; innovations such as recycle-ready films ensure product integrity while offering consumer-friendly storage solutions like flat-bottom bags.”

– Rebecca Casey, SVP Sales and Strategic Marketing, TC Transcontinental Packaging

Image courtesy of Marc Rapp

“One of the main challenges in adopting sustainable alternatives to plastic is that existing manufacturing equipment often cannot process new materials like starch-based bio-resins or materials containing more than 80% Post-Consumer Recycled (PCR) content. Additionally, both converting and filling equipment at the client’s facility may need to be upgraded, often requiring substantial investment in new material technologies. Success in integrating sustainable materials into the packaging process depends on streamlining the entire production workflow – from resin production to extrusion, converting, and filling. Only when these processes are aligned with the new material technologies will the transition to sustainable alternatives be successful.”

– Marc Rapp, CEO of Floeter and AirWave Packaging

Markets, Materials & Formats

“The U.S. flexible packaging industry remains well-positioned to continue to lead the packaging of products in the U.S.,” says FPA’s Dan Felton.

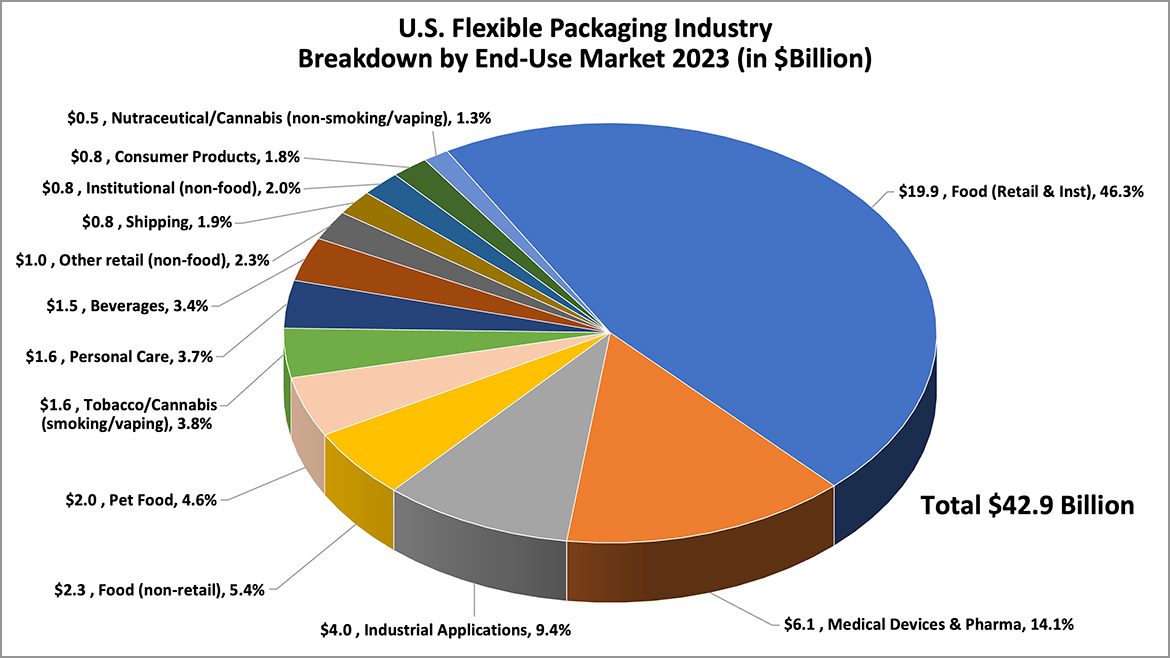

According to FPA’s recently released “2024 State of the U.S. Flexible Packaging Industry Report,” the U.S. flexible packaging industry was estimated to reach $42.9 billion in annual sales in 2023, marking a 3.3% growth from $41.5 billion in 2022. FPA forecasts that the industry will grow to $47.3 billion in 2028, representing a compound annual growth rate (CAGR) of 2.0% from 2023 to 2028.

Flexible packaging continues to hold a significant portion of the U.S. packaging market, representing 20% of the total $210.8 billion U.S. packaging market. The only category currently surpassing flexible packaging is corrugated materials, which account for 22% of the U.S. packaging market.

Food packaging for retail, institutional, and non-retail environments remains the largest end-use market for flexible packaging in the U.S., contributing $22.2 billion in annual sales, or close to 52% of the market. The medical and pharmaceutical sectors follow closely with $6.1 billion in sales, holding a 14% market share. Other markets, including beverages, non-retail food, and personal care, make up smaller portions of the market, with each contributing less than 6%.

Source: Flexible Packaging Association

Turning to materials and formats, films and resins account for the largest input spend for converters, with those two categories accounting for over 70% of material purchases – films at 51% of spend and resins at 22%. Within films, polyethylene (PE) continues to be the dominant material, with nearly all (95%) converters responding to FPA’s survey saying they use PE.

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!

Rollstock remains the dominant format produced by converters surveyed, accounting for 55% of dollar value, and 96% of converters producing this format. When looking at the type of products that are used in the rollstock category, the “Bags & Pouches, Stand-up, Non-retort” format is the leader in overall flexible packaging formats by converters at 50%, with “Bags & Pouches, Lay Flat, Non-retort” a close second in converter participation (46%) but leading in overall portion of net sales.

Concrete Solutions

Innovation in flexible packaging never ceases. While it’s not possible to enumerate and celebrate all of those innovations here, we wanted to share some of the most insightful observations we received regarding flexible packaging’s progress on sustainability and how flexible packaging is meeting the needs of specific vertical markets.

Image courtesy of Parkside

Staci Bye, Sales Account Manager at Parkside, shared her expert insights on lightweighting, material reduction, and paperization.

Lightweighting and material reduction

Flexible packaging is experiencing exciting growth, which is set to continue throughout the decade and beyond. It is generally lighter weight and uses fewer materials than rigid alternatives, while still offering excellent barrier performance. Beyond this, it comes with many logistical benefits owing to its flexible nature – for example, it means more packs can be shipped in a single consignment, resulting in less air being shipped and reduced transport emissions.

One major converting trend that relates to this is lightweighting. In many cases, this involves swapping a rigid pack with a flexible alternative, such as a pouch. It can also involve replacing an existing flexible material – usually a heavier weight polymer laminate – with a lighter or thinner grade of material, which can save a few grams per pack. While this does need to be approached with care so as not to compromise the product protection or consumer experience, using material innovations to make small weight savings on each pack can add up to a huge difference to a business’s costs and carbon footprint when scaled across an entire packaging portfolio.

Progress on paperization

As a result of the complexity surrounding plastic flexible packaging design today, paperization is one of the key trends influencing the market. Paper solutions have advanced significantly in recent years, making them suitable for more applications than ever before, and they remain widely recycled within current recycling infrastructure.

Packages featuring Parkside’s Recoflex™ recyclable packaging. Image courtesy of Parkside

Parkside’s Recoflex™ range is an example of the kind of paper-based innovation serving this trend. We utilize a vapor deposition of aluminum to create a metallized paper laminate that is fully recyclable while still offering high barrier performance against grease, oxygen, and moisture. Alternatively, we can use a PE co-extrusion to create a moisture barrier that repels ice crystals, making it suitable for frozen applications – again, without compromising its recyclability.

Rebecca Casey, SVP Sales and Strategic Marketing, TC Transcontinental Packaging, shared her insights on sustainability, innovation and consumer expectations.

Sustainable and recyclable materials, such as BOPE films that TC Transcontinental Packaging is developing, are gaining popularity for reducing environmental impact while offering practical features like clean, easy tears. The industry is also transitioning more and more to flexible formats from rigid formats, which helps improve environmental footprints. For example, flexible designs and packages such as TC Transcontinental Packaging’s Hot N’ Handy rotisserie chicken pouch replacing rigid clamshells provide a more sustainable and functional alternative.

TC Transcontinental Packaging’s innovative sustainable packaging solutions for the pet food industry include its VieVERTe® sustainable product portfolio, which leverages the benefits of flexible packaging such as extending shelf life, reducing food waste, and providing product protection while reducing its environmental footprint. Image courtesy of TC Transcontinental Packaging

Innovation in emerging trends also includes the rise of interactive and smart packaging. Consumers increasingly value packages enriched with technology, such as QR codes that provide transparency about product origins, sustainability practices, or usage information. Meanwhile, minimalist design is gaining traction as consumers seek sleek, fuss-free packaging that signals environmental responsibility without unnecessary material. Balancing aesthetics with functionality, these trends are reshaping the way brands present their products.

Consumer expectations for transparency and eco-consciousness are high among younger generations, including Millennials and Gen Z. They’re willing to support products that prioritize sustainability, particularly those with reusable or recyclable packaging.

PaperWave air cushions replacing single-use plastic in ecommerce. PaperWave air cushions are made from 100% recycled paper and are compostable in nature. Image courtesy of AirWave

Marc Rapp, CEO of Floeter and AirWave Packaging, shared his insights on the trend toward sustainability in ecommerce.

Flexible packaging represents not only a significant segment of plastic applications but also an essential element of product presentation. It plays a crucial role in protecting goods during transport and shipping, addressing both known and unforeseen issues. The primary function of packaging is to safeguard the product from damage, environmental factors, and contamination.

In recent years, global discussions within the packaging industry have shifted focus. While protection and cost were once the dominant concerns, the environmental impact of packaging is now at the forefront of these discussions. Ecommerce consumers worldwide have made it clear that they do not want their shopping experience to come with a significant environmental burden. Major companies like Amazon and IKEA are leading the way by embracing sustainability, showing that minimizing environmental impact in packaging is a growing megatrend.

The shift toward reducing packaging materials, using fiber-based materials, and prioritizing recyclability or compostability is gaining traction. This movement is not only driven by consumer demand but also by increased scrutiny from policymakers and the scientific community on the environmental implications of packaging waste.