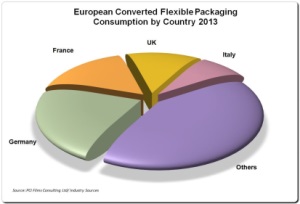

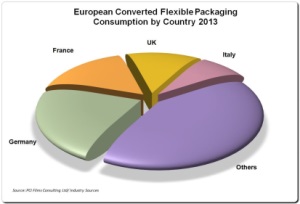

Declining demand in a number of national markets, principally France and Italy, and the continuing lack of significant inflationary pressures, are the main factors behind growth in Europe’s flexible packaging market slowing to 1.3 percent in both value and volume terms in 2013, down from 2.1 percent and 1.8 percent respectively in 2012.

Declining demand in a number of national markets, principally France and Italy, and the continuing lack of significant inflationary pressures, are the main factors behind growth in Europe’s flexible packaging market slowing to 1.3 percent in both value and volume terms in 2013, down from 2.1 percent and 1.8 percent respectively in 2012.

Declining demand in a number of national markets, principally France and Italy, and the continuing lack of significant inflationary pressures, are the main factors behind growth in Europe’s flexible packaging market slowing to 1.3 percent in both value and volume terms in 2013, down from 2.1 percent and 1.8 percent respectively in 2012.

Declining demand in a number of national markets, principally France and Italy, and the continuing lack of significant inflationary pressures, are the main factors behind growth in Europe’s flexible packaging market slowing to 1.3 percent in both value and volume terms in 2013, down from 2.1 percent and 1.8 percent respectively in 2012.