Spending on Flexible Packaging in North America to Reach $25 Billion by 2018

Demand in North America’s converted flexible packaging market has been underpinned by recovering economies and flexible packaging formats being used as alternatives to traditional rigid packaging

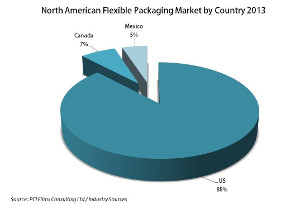

The North American converted flexible packaging market accounts for approaching 30 percent of global consumption with an annual spend of $20.7 billion in 2013, reveals a new report from PCI Films Consulting. Approaching 90 percent of sales in the region are concentrated in the US, with Canada and Mexico accounting for 7 percent and 5 percent respectively. ‘The North American Flexible Packaging Market to 2018’ provides a comprehensive assessment of historic trends and the current state of the market and also includes forecasts of how PCI expects the market to develop over the next five years in the US, Canada and Mexico.

After slowing in 2012 due to the economic downturn, demand for converted flexible packaging recovered to grow by around 4 percent by value in the US and Canada in 2013. However, the Mexican flexible packaging market slowed markedly during the year to around 1.5 percent due to uncertainties following the change of government and slowing GDP growth. Weakening margins and other competitive pressures caused significant rationalization and restructuring in the region with many plant closures and divestments, especially amongst the leading players.

The report notes that industry consolidation continues to be an important factor in driving change in this very fragmented industry with private equity firms continuing to play a key role. Important private equity deals in 2013 have included Constantia Flexibles’ acquisition of Globalpack, both portfolio investments of One Equity Partners, and Constantia’s subsequent purchase of the US-based Spear labelling group. Also, private equity firm Sun Capital brought together its Exopack Holdings business in North America and four of its packaging portfolio businesses in Europe to form Coveris Exopack Holdings.

For the future, converted flexible packaging growth in North America is forecast to average around 4 perecent per annum to reach over $25 billion by 2018 with growth in Mexico expected to bounce back to grow at US and Canadian levels over the period. Per capita consumption of flexible packaging in Mexico is less than one-fifth of the US figure, illustrating its potential for future growth. The North American Free Trade Agreement (NAFTA) also continues help drive demand in Mexico, with many US packaged food companies manufacturing in Mexico for the US market to take advantage of lower labour rates.

Commenting on the report, PCI consultant Paul Gaster says, “While the economic slowdown adversely impacted the flexible packaging industry’s profitability, volume growth has continued to be sustained by servicing primarily defensive markets such as food, pharmaceuticals and pet food. Also, as packaging technologies have evolved, flexible packaging is becoming a viable alternative to rigid formats in a growing number of applications, with the stand-up pouch enjoying strong volume growth.”

Now in its 4th edition, PCI Films Consulting’s report ‘The North American Flexible Packaging Market to 2018’ gives all the detail behind the headlines, with statistics and in depth commentary on industry trends, converter profiles and descriptions of trends in 16 individual end use markets in each country; providing essential reading for suppliers, converters, buyers and investors in this huge market. The report is available from PCI Films Consulting Ltd.

PCI Films Consulting Ltd.

+44(0) 1604 749001

Looking for a reprint of this article?

From high-res PDFs to custom plaques, order your copy today!